Renters Insurance in and around Saint Louis

Saint Louis renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's a townhome or a house, protection for your personal belongings is a wise idea, whether or not your landlord requires it.

Saint Louis renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

It's likely that your landlord's insurance only covers the structure of the space or home you're renting. So, if you want to protect your valuables - such as a video game system, a smartphone or a bicycle - renters insurance is what you're looking for. State Farm agent Josh Arnold has the knowledge needed to help you examine your needs and keep your things safe.

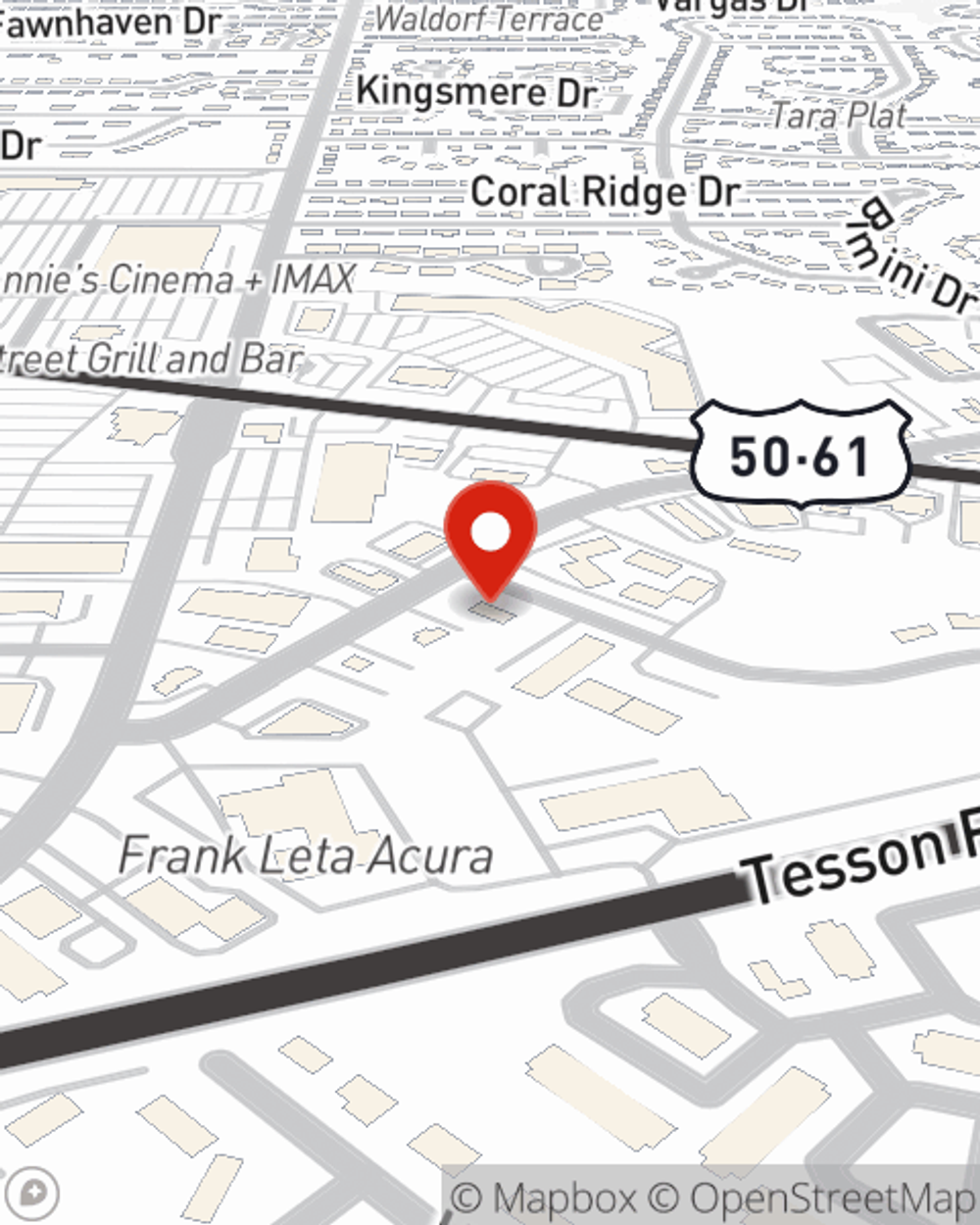

A good next step when renting a house in Saint Louis, MO is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and find out how State Farm agent Josh Arnold can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Josh at (314) 939-1716 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Josh Arnold

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.